Key Takeaways

- Churches face dual decline: Membership and financial support are shrinking across most traditional denominations, particularly among Mainline Protestant and Catholic congregations.

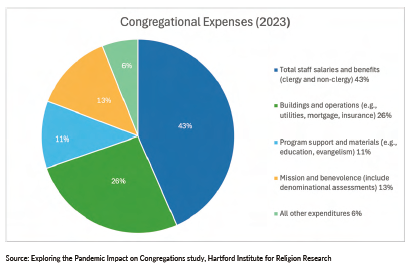

- Cost structures are inflexible: High fixed costs and aging infrastructure make adaptation difficult without proactive change.

- Tactical and strategic actions exist: Churches can survive and even thrive by embracing creative facility use, expanding ministries, sharing resources, or pursuing mergers.

Across the U.S., churches are closing their doors at unprecedented rates. Financial distress, aging congregations, and declining attendance are combining to create an existential crisis for many faith communities. This paper examines the root causes and outlines practical paths forward — both tactical and strategic — to ensure churches can continue their spiritual mission in a sustainable way.

Understanding the Crisis

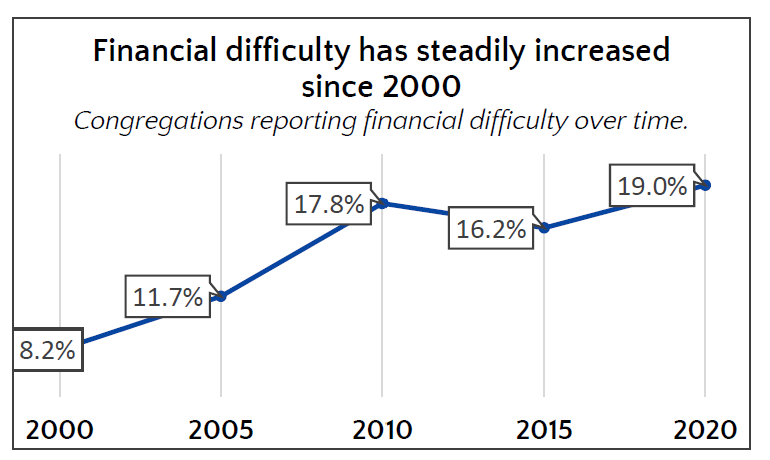

Churches today increasingly face financial pressure. In some mainline Protestant denominations, over 25% are reportedly in financial crisis. As many as 20% of Catholic parishes are struggling. On the other hand, the growing Nondenominational and Evangelical churches much more rarely report financial pressure. Financial distress is also much more common in smaller churches.

The media regularly report the decline in organized religious faith in the U.S., so financial distress is no surprise. But the underlying reasons are more complex.

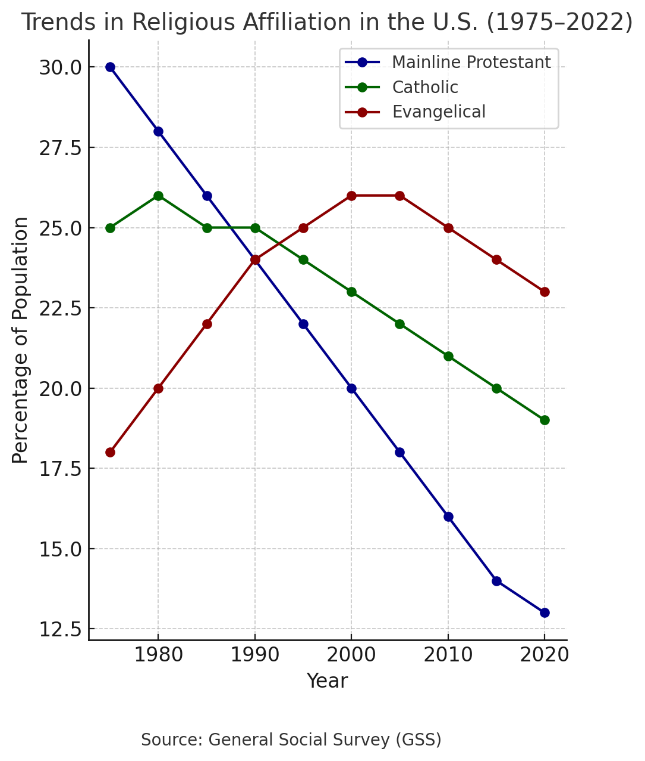

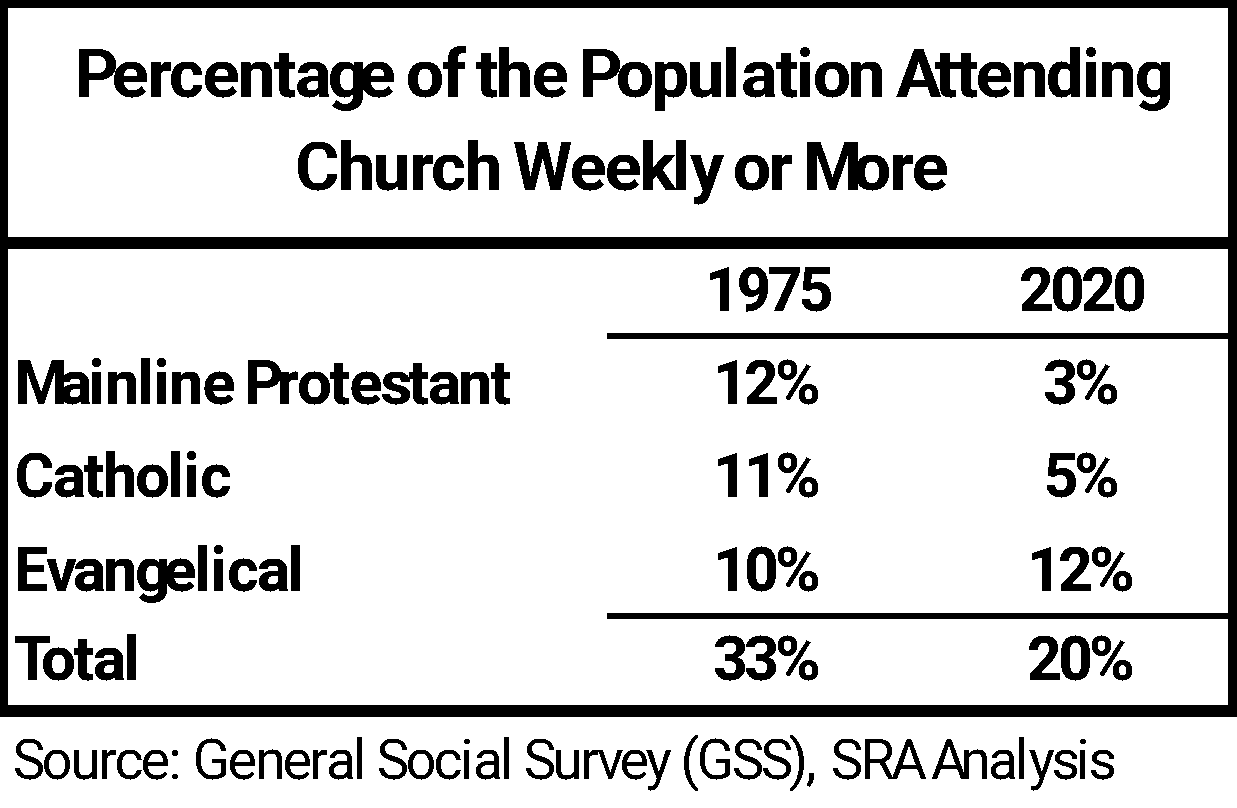

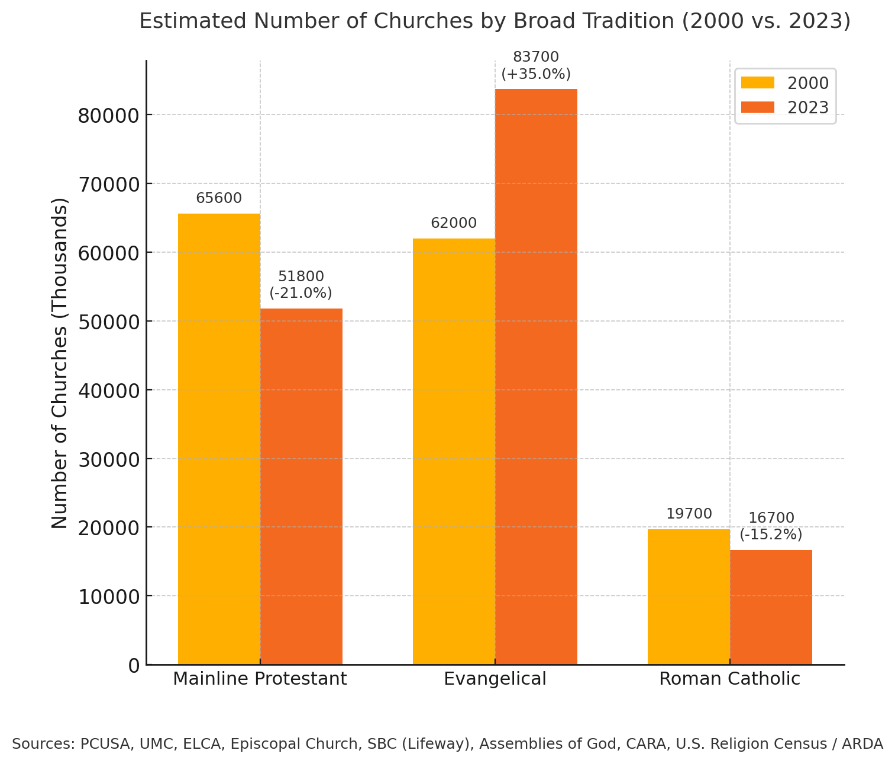

Religious affiliation among Mainline Protestant, Catholic, and Evangelical groups has declined since 2000. Prior to that, Evangelicals were growing, driven by breakaways from Mainline churches and the rise of new congregations aimed at younger, educated professionals seeking spiritual community, as noted by Peter Drucker.

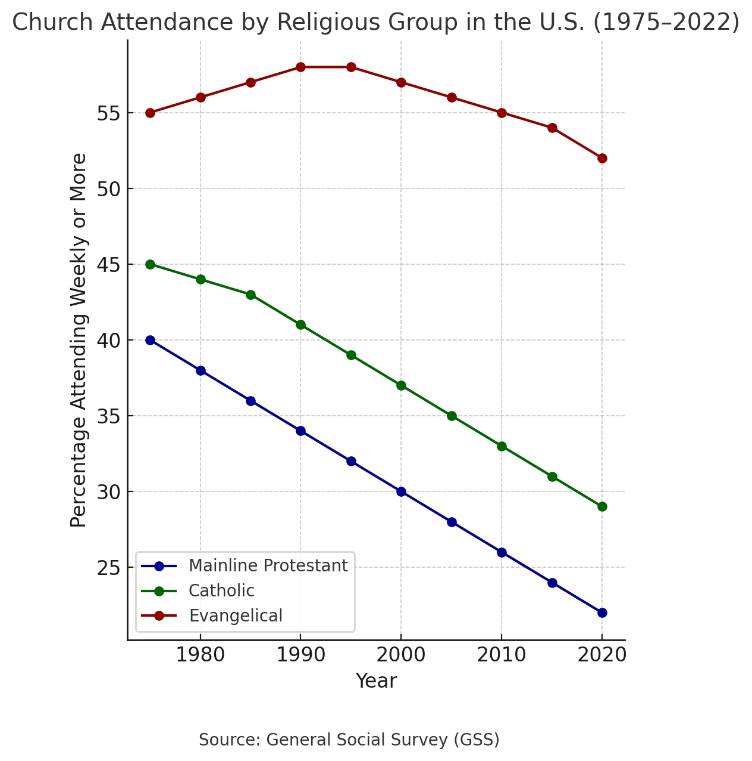

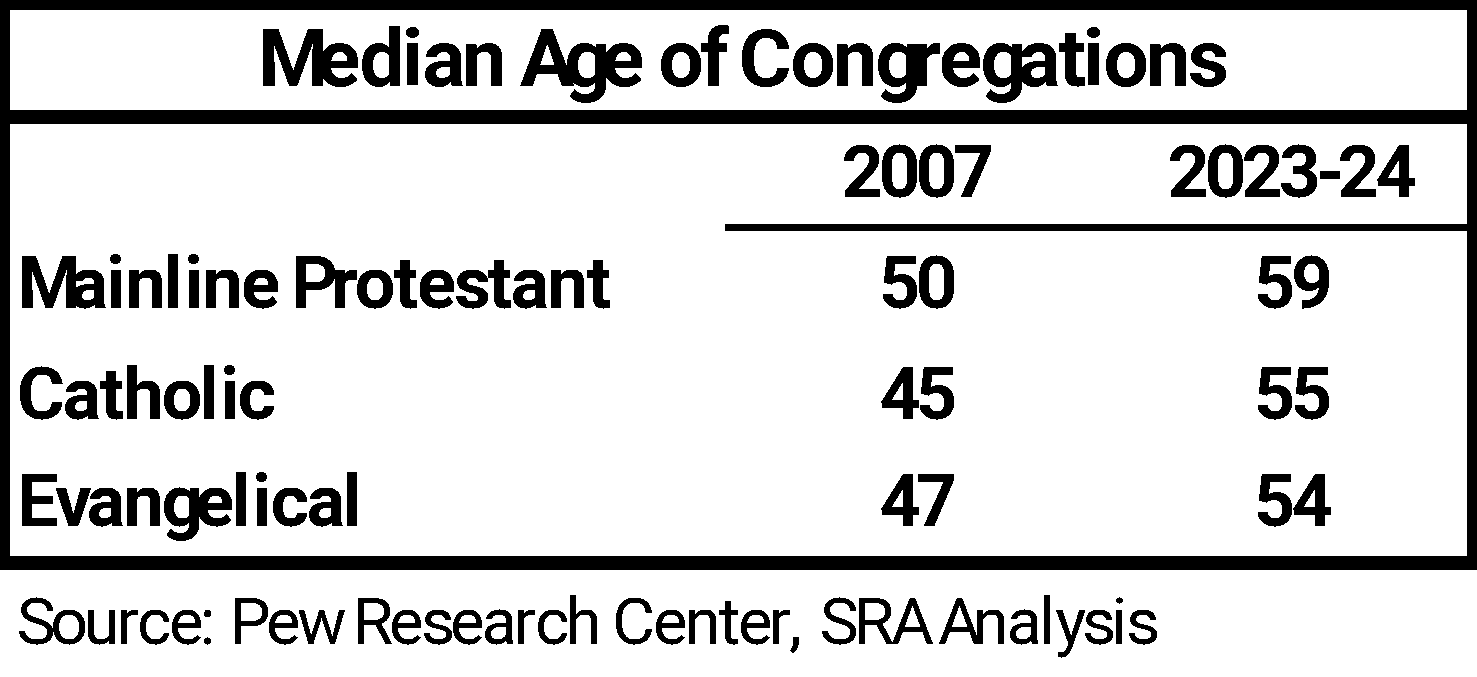

This decline in affiliation is compounded by falling attendance even among those who still identify with a church.

To round out the demographic picture, the age of the clergy is also increasing. Fewer are hearing the call to ministry and are available to provide the engine for growth by attracting new parishioners.

Financial Distress and Rigid Costs

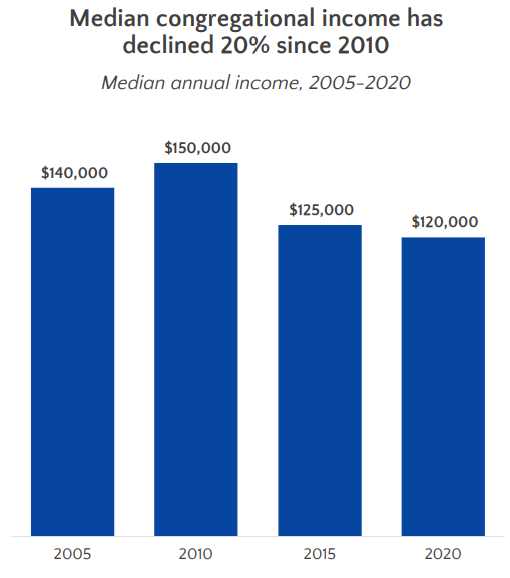

To complete the picture, church revenue echoes the decline in membership, attendance, and number of churches.

Despite their spiritual mission, churches function as economic entities and must remain financially viable to sustain their operations. They need financial resources to carry out that mission. If those resources don’t support the mission, the church fails, and its mission is not met. To put the facts above in this perspective, we can look at churches as businesses: demand is down in most segments and customers are aging out; management is hard to get, and revenues are declining.

Thus, it is easy to see why 19% of churches report themselves to be in financial distress. They are caught in the vice of declining membership and attendance, reduced revenue, and a cost base that they can do little to flex down to respond to the challenges.

What Can Be Done?

Not every church can suddenly become a Nondenominational congregation or attract a charismatic leader. For those without a “silver bullet,” a combination of tactical and strategic responses offers the best path forward.

In our surveys of successful responses to these challenges, we see a range of tactical and strategic actions. The tactical plans take the existing “model” as given and look for improvements that relieve financial pressure. The strategic alternatives look to make fundamental changes to the church’s mission or structure.

Tactical Options

Improve Facility Utilization

Underutilized property can be repurposed or leased to nonprofits, schools, or community groups. Churches can also consider subdividing or selling unused land.

Embrace Digital Ministry

Expanding online offerings helps churches remain accessible, particularly for aging members. Streaming services, offering virtual devotions, and enabling online giving can all increase engagement and financial support. Digital stewardship tools also modernize the giving experience and remove barriers for those participating remotely.

Reframe and Expand the Ministry

Think of this as broadening the church’s “product line.” Many communities need services like youth programming, counseling, food security, and elder care. Meeting these needs can draw in new members, reinvigorate current ones, and unlock grant or philanthropic funding for facilities and operations.

Conduct a Zero-Based Budget Review

Church budgets often contain legacy programs or expenses that no longer align with current needs. A rigorous annual review—starting from zero—can help the finance committee set new priorities and free up resources for higher-impact initiatives.

Strategic Options

When tactical steps aren’t enough, churches must consider more transformative changes.

Rethink Staffing and Leadership

Clergy salaries are often the largest line item. While difficult, reducing staff or moving to part-time (bivocational) clergy may be necessary. Small churches might share a pastor (a “yoked” ministry) or consolidate administrative roles with nearby congregations. Lay leadership can also take on expanded responsibilities.

Downsize Physical Space

If the current facility no longer fits the congregation’s size or finances, relocation may be the right move. Selling the property can provide critical liquidity, while leasing smaller or shared space can reduce overhead and foster flexibility.

Consider a Merger

Merging with a nearby congregation can be a life-giving strategy. It allows for combining congregations, resources, and leadership. The sale of one facility can fund upgrades or create an endowment for the future. A well-planned merger respects both legacies while building a stronger foundation.

Sound Restructuring Advisors (“SRA”) (https://soundrestructuringadvisors.com/ ) specializes in advising distressed nonprofit organizations, including churches. We have the expertise to assist in understanding the underlying issues of the church and developing, with the lay and clerical leadership, a plan for returning the church to financial stability. Importantly, SRA will assist with the implementation of the plan.